Certified Financial Advisor and Planner in Mumbai

Financial Advisor in Mumbai – Strategic Wealth Planning with FinAtoZ

If you are looking for a reliable financial advisor in Mumbai, FinAtoZ provides structured and goal-oriented financial solutions tailored for professionals, entrepreneurs, and families. In a fast-moving financial city like Mumbai, working with an experienced financial advisor in Mumbai ensures that your income, savings, investments, and long-term goals are aligned strategically.

At FinAtoZ, we combine the expertise of a professional financial planner in Mumbai, a disciplined investment advisor in Mumbai, and a qualified certified advisor in Mumbai to provide end-to-end financial clarity. Instead of fragmented advice, you get a comprehensive strategy under one advisory framework.

Comprehensive Financial Planning in Mumbai

A structured financial roadmap is essential in a dynamic city like Mumbai. As a trusted financial advisor in Mumbai, we focus on clarity, planning, and disciplined execution. Our role as a financial planner in Mumbai is to design goal-based strategies, while our investment advisor in Mumbai ensures your portfolio reflects those goals. Every recommendation is reviewed under the supervision of a certified advisor in Mumbai to maintain professional standards.

Our Financial Planning Approach

As your dedicated financial planner in Mumbai, we help with:

- Goal-based financial structuring

- Retirement corpus building

- Children’s education planning

- Wealth preservation strategies

- Tax-efficient investment structuring

- Risk management and asset allocation

Your financial advisor in Mumbai conducts detailed consultations to understand your financial situation. Based on this, your investment advisor in Mumbai creates a disciplined portfolio while your certified advisor in Mumbai ensures compliance and ethical advisory practices.

Investment Advisory Services in Mumbai

Working with an experienced investment advisor in Mumbai is critical for long-term wealth growth. Markets fluctuate, but disciplined strategies create sustainable returns. Our financial advisor in Mumbai ensures that investments are aligned with life goals, while our financial planner in Mumbai integrates those investments into your broader financial strategy.

As a structured investment advisor in Mumbai, we provide:

- Mutual fund advisory

- Equity portfolio structuring

- Debt and fixed-income allocation

- Long-term wealth creation plans

- Periodic portfolio review and rebalancing

Each strategy is designed by a financial planner in Mumbai and monitored by a certified advisor in Mumbai to ensure risk-adjusted growth.

Retirement Planning with a Certified Advisor in Mumbai

Retirement planning requires expertise and long-term foresight. A professional certified advisor in Mumbai evaluates inflation impact, lifestyle expectations, and longevity risk before recommending strategies. Your financial advisor in Mumbai calculates required corpus size, while your investment advisor in Mumbai allocates assets strategically.

With support from a financial planner in Mumbai, you can:

- Build a stable retirement corpus

- Protect wealth from inflation

- Create systematic withdrawal strategies

- Ensure financial independence post-retirement

Choosing a certified advisor in Mumbai ensures that your retirement planning is structured and professionally guided.

Tax Planning and Wealth Optimization

Efficient tax structuring is essential in Mumbai’s high-income environment. As a proactive financial advisor in Mumbai, we integrate tax planning into your overall strategy. Our financial planner in Mumbai identifies tax-saving opportunities, while the investment advisor in Mumbai recommends instruments aligned with tax efficiency. A certified advisor in Mumbai ensures that all strategies follow regulatory guidelines.

Who Should Work with a Financial Advisor in Mumbai?

You should consider working with a financial advisor in Mumbai if you are:

- A salaried professional seeking structured financial planning

- A business owner requiring tax-efficient wealth growth

- An NRI connected to Mumbai investments

- A family planning long-term financial security

- An entrepreneur seeking strategic portfolio management

Our financial planner in Mumbai designs personalized roadmaps, our investment advisor in Mumbai manages disciplined execution, and our certified advisor in Mumbai ensures compliance and transparency.

Why Choose FinAtoZ as Your Financial Advisor in Mumbai

- Dedicated financial advisor in Mumbai for personalized strategies

- Experienced financial planner in Mumbai for structured goal planning

- Professional investment advisor in Mumbai for portfolio growth

- Qualified certified advisor in Mumbai for ethical and compliant advisory

- Regular portfolio tracking and performance reviews

- Long-term wealth partnership approach

Instead of dealing with multiple disconnected advisors, you get an integrated financial advisory solution in Mumbai.

Frequently Asked Questions

What does a financial advisor in Mumbai do?

A financial advisor in Mumbai helps manage your overall financial strategy, including planning, investments, and risk management.

How is a financial planner in Mumbai different from an investment advisor in Mumbai?

A financial planner in Mumbai focuses on comprehensive financial planning, while an investment advisor in Mumbai primarily manages and structures your investment portfolio. At FinAtoZ, both roles work together.

Why should I choose a certified advisor in Mumbai?

A certified advisor in Mumbai ensures that financial recommendations follow professional, ethical, and regulatory standards.

How often does an investment advisor in Mumbai review portfolios?

Your investment advisor in Mumbai conducts periodic reviews to ensure alignment with financial goals and market conditions.

Can a financial advisor in Mumbai help with retirement planning?

Yes. A financial advisor in Mumbai, along with a financial planner in Mumbai and certified advisor in Mumbai, creates structured retirement strategies.

Get Expert Financial Advice

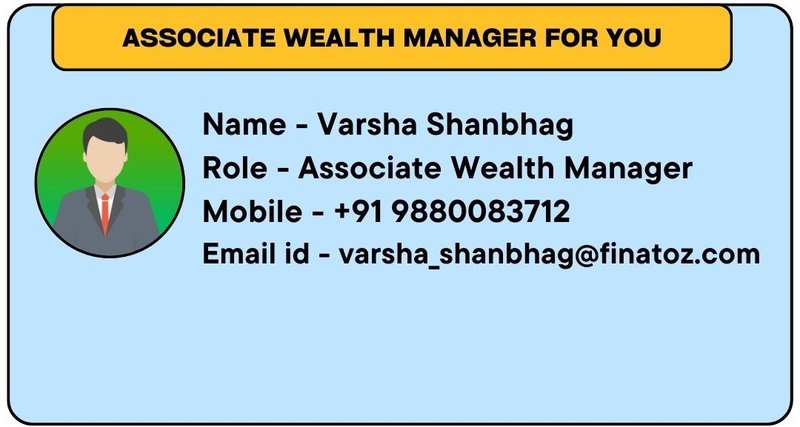

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment