Why NRIs Should Use GIFT City to Invest in India?

“The future depends on what you do today.” — Mahatma Gandhi

As India’s economy expands rapidly, NRIs are increasingly seeking efficient ways to participate in this growth — and GIFT City is emerging as the smart gateway to invest back home.

GIFT City (Gujarat International Finance Tec-City) is India’s first International Financial Services Centre (IFSC). Designed to attract global capital and onshore offshore financial activities, it is fast becoming the go-to platform for Non-Resident Indians (NRIs) who wish to invest directly into India with minimal tax hurdles, robust regulatory clarity, and full repatriation ease.

Why GIFT City Makes Sense for NRIs

NRIs traditionally invest in India through routes like NRE/FCNR deposits, direct equity, or real estate. These can involve complex tax treatment, high TDS, and repatriation hurdles. GIFT City provides a modern alternative:

- Tax Efficiency: No capital gains tax on certain instruments, no STT/CTT, and tax-free interest on foreign currency deposits.

- For UAE- and Singapore-based NRIs, GIFT City’s tax advantages are even more attractive — many investments enjoy zero or reduced tax on income or dividends under India’s Double Taxation Avoidance Agreements (DTAA) with these countries.

- Full Repatriation: Funds invested, and gains earned through GIFT City can be freely repatriated abroad without complex FEMA paperwork.

- Regulatory Clarity: A single regulator (IFSCA) oversees all transactions, reducing red tape.

- Foreign Currency Flexibility: Hold and invest in USD or other major currencies without forced INR conversion.

Easy Onboarding:

- Open an IFSC account online with an IFSC-registered broker or bank.

- Complete digital KYC with passport, visa, and overseas address proof.

- Fund your account through your NRE account.

- Start investing in India-focused AIFs, debt instruments, or insurance products.

No PAN is mandatory for most products (though individual brokers may have their own requirements).

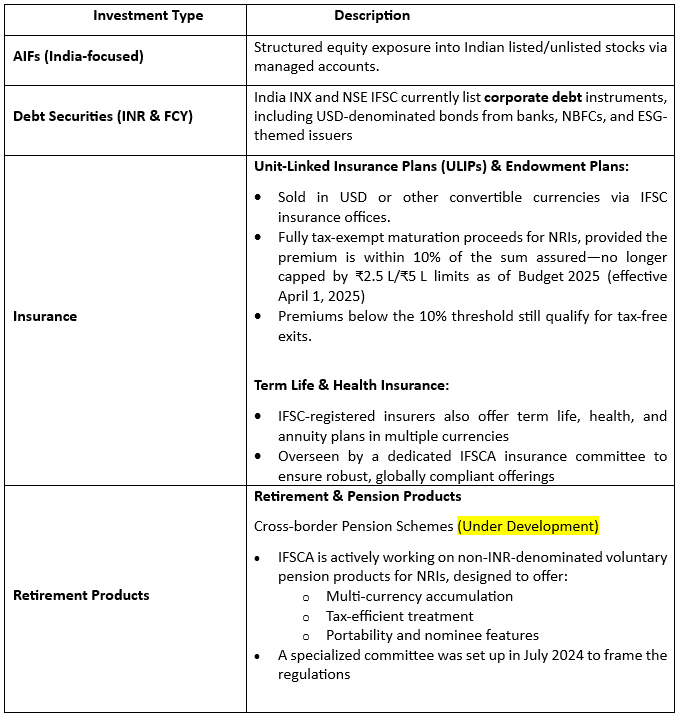

Key India-Focused Investment Options at GIFT City:

Inbound Investment Options (Investing into India from Abroad)

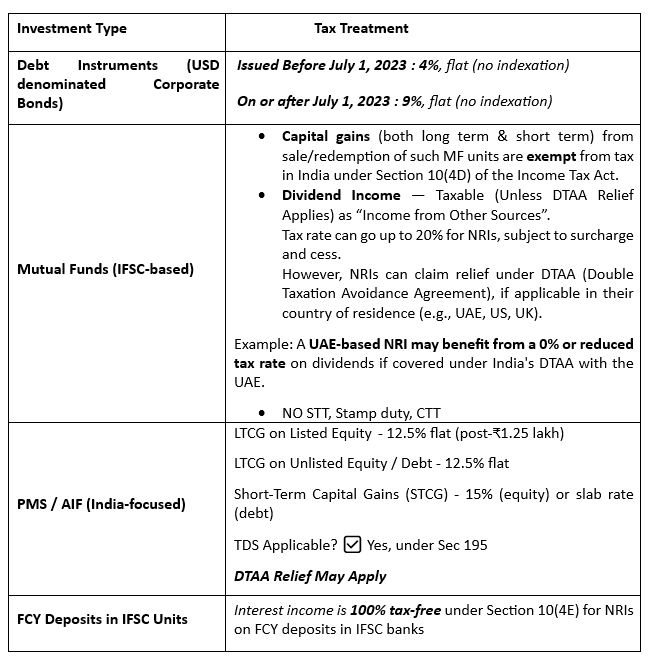

Product-wise Taxation :

NRIs investing through GIFT City enjoy a significantly more tax-friendly regime compared to traditional routes. Here’s how various products are taxed:

Note: Section 10(4D/4E/4F) of the Income Tax Act provides for tax exemptions, only on select global assets not on India-focussed.

All funds are 100% repatriable with no additional RBI approval needed.

Is GIFT City Right for You?

If you want to invest in India’s growth story with:

- Lower taxes

- Full repatriation of capital and returns

- No hidden FEMA restrictions

- Globally compliant, professional investment avenues

… then GIFT City is the clear choice.

Explore your options today and make India’s growth work for your global portfolio!

Talk to your wealth advisor at FinAtoZ to get started.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment