Understanding NPS & PPF: Which Retirement Savings Scheme Suits You Best?

Understanding NPS & PPF: Which Retirement Savings Scheme Suits You Best?

Planning for retirement is one of the most important financial goals in life. Among India’s top government-backed savings options, the National Pension System (NPS) and the Public Provident Fund (PPF) stand out. Both help you build a stable corpus, but they differ in terms of returns, flexibility, and risk. Understanding the difference between NPS and PPF can help you choose the right option for your financial future. This guide explains each scheme’s features, benefits, and suitability to help you make an informed retirement planning decision.

National Pension System (NPS)

The National Pension System (NPS) is a government-backed savings plan. It was introduced by the Central Government to help individuals build retirement income.

The Pension Fund Regulatory and Development Authority (PFRDA) manages and regulates the scheme under the PFRDA Act, 2013.

NPS is a market-linked defined contribution plan. It allows you to save regularly for your future. The scheme is voluntary, simple, portable, and flexible. It helps you create a retirement corpus while offering tax-saving benefits. It is one of the most effective ways to build financial security for your post-retirement life.

Who Can Invest in NPS

NPS is open to all Indian citizens. It offers different models based on user segments:

- Central Government Employees: All employees who joined on or after January 1, 2004, are covered under NPS, except those in the armed forces. Employees of Central Autonomous Bodies are also included.

- State Government Employees: Available to state and union territory employees if their government has opted for it.

- Corporate Employees: Companies can voluntarily offer NPS benefits to their staff. Contributions are made in accordance with employment terms.

- All Citizens Model: Open to any Indian citizen, including NRIs, aged between 18 and 70 years.

Eligibility for NPS

The National Pension System (NPS) is open to Indian citizens, including residents, non-residents, and Overseas Citizens of India (OCI). You must be between 18 and 70 years old at the time of application. You also need to complete KYC verification with a valid ID and address proof. Hindu Undivided Families (HUFs) and Persons of Indian Origin (PIOs) cannot open NPS accounts.

Check eligibility in detail.

Models Under NPS

- All Citizen Model: Open for all Indian citizens, including NRIs and OCIs.

- Central Government / CABs Model: Covers all Central Government employees (except Armed Forces) and those in Central Autonomous Bodies.

- State Government / SABs Model: Applies to employees of State Governments and State Autonomous Bodies that have adopted NPS.

- Corporate Model: Available to employees whose companies have opted for NPS.

Retirement Benefits for NPS Employees

1. Flexible

You can choose how to invest your money. NPS lets you decide your asset allocation across four asset classes based on your risk level. You can also switch your pension fund manager or scheme at any time.

2. Simple and Tax-Efficient

When you open an NPS account, you get a Permanent Retirement Account Number (PRAN). This 12-digit number stays the same for life. You also enjoy tax benefits under the Income Tax Act, 1961, making NPS both easy and rewarding.

3. Portable

Your NPS account moves with you. Whether you change jobs, cities, or sectors, your account remains active. You can continue with the same scheme or choose a new one.

4. Regulated and Transparent

NPS is managed by PFRDA and monitored by the NPS Trust. All investments follow strict and transparent guidelines, ensuring your money is safe.

5. Low Cost and Power of Compounding

NPS has one of the lowest maintenance costs worldwide. Over long periods, low fees and compounding growth help build a larger retirement corpus.

6. Online Access

You can open and manage your NPS account online through the eNPS portal. Online payments and account management make saving simple and convenient.

The NPS Pension Calculator helps you estimate your future income. It shows the expected pension and lump-sum amounts you may receive at retirement.

You can enter your monthly contribution, investment duration, and expected return rate. The calculator also factors in how much of your corpus will be reinvested for annuity purchase.

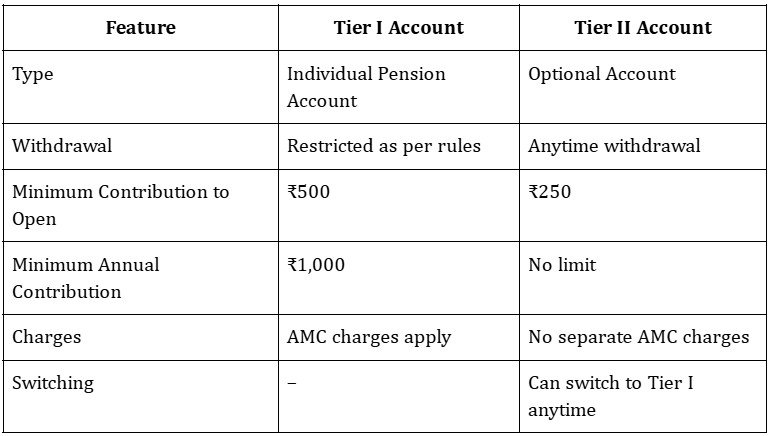

Types of Accounts in the NPS Scheme

Tier I Account

This is your main retirement account. Regular contributions from you and your employer go into this account. The money is invested based on your selected fund manager and scheme. Withdrawals are allowed only under specific exit and withdrawal rules.

Tier II Account

This is an optional savings account available only to those with an active Tier I account. You can withdraw money anytime you need to.

Public Provident Fund (PPF)

The Public Provident Fund (PPF) is a government-backed savings scheme ideal for long-term and low-risk investors. It helps you build a steady corpus for PPF retirement planning while enjoying tax-free returns.

Key Features

- Minimum Deposit: ₹500 per financial year.

- Maximum Deposit: ₹1,50,000 per financial year.

- Deposits can be made in one lump sum or in installments.

Loan and Withdrawal Facility

- You can take a loan from your PPF account between the 3rd and 6th financial year.

- Partial withdrawals are allowed every year starting from the 7th financial year.

Maturity and Extension

- The account matures after 15 years from the end of the financial year in which it was opened.

- After maturity, you can extend the account for 5-year blocks, with or without new deposits.

- You can also retain the account indefinitely without deposits and still earn interest at the prevailing rate.

Tax Benefits

- Deposits qualify for deduction under Section 80C of the Income Tax Act.

- The interest earned is tax-free under Section 10.

- The amount in your PPF account cannot be attached by any court order, ensuring safety and security.

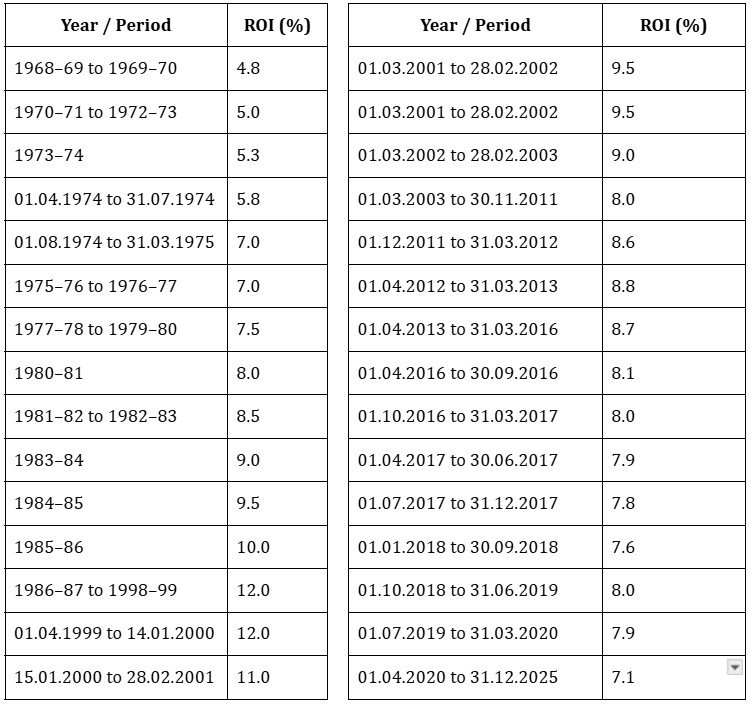

Public Provident Fund Account Interest Rate Since Inception

Requirements for Opening an Account under National Savings Schemes

To open an account under any National Savings Scheme, you must fill out Form 1 and submit it to your nearest Post Office or Bank.

- Personal details: Full name, date of birth, and guardian’s name (if applicable).

- Photograph: A recent passport-size photo of the applicant.

- Identification details:

- Aadhaar number

- PAN card

- Address proof: Current and permanent address with contact number and email ID.

- Proof of identity: Any of the following documents:

- Passport

- Driving License

Voter ID - PAN Card

Aadhaar Card

NREGA Job Card (signed by a State Government Officer) - Nomination details: Name, address, Aadhaar, and date of birth of the nominee.

- Initial deposit: Cash, cheque, or DD of the minimum required amount.

- Specimen signatures or thumb impression of the applicant.

- Declaration: You must agree to follow the Government Savings Promotion Rules, 2018.

Download Form 1 – National Savings Schemes Application

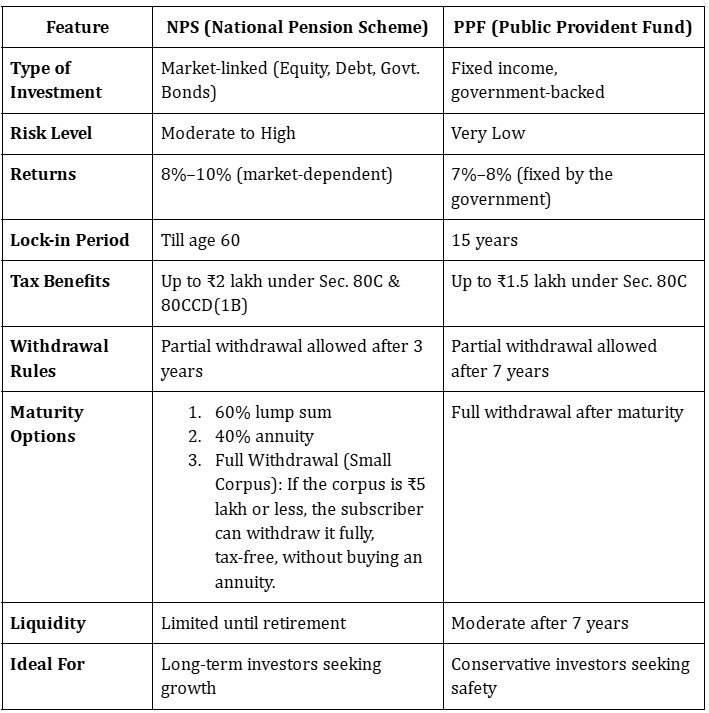

Difference Between NPS and PPF

How FinAtoZ Can Help You Plan Smarter

At FinAtoZ, we help you achieve your financial goals with smart, personalized planning.

Our Approach

- Goal Planning: We understand your needs and design a plan to help you achieve your life goals.

- Protection: We identify the right insurance to safeguard your family and finances.

- Asset Allocation: We create the ideal investment mix based on your risk profile and life stage.

- Tax & Estate Planning: We guide you on tax-efficient products and wealth transfer strategies.

Investment Support

We help you invest in Mutual Funds, PMS, P2P lending, and real estate products through our 5P Research Process. Our expert team uses rigorous tools to select the best options for you.

You also get a consolidated view of your investments on our online portal, along with continuous tracking and timely reviews to keep you on course.

Frequently Asked Questions - FAQs

Can I invest in both NPS and PPF?

Yes, you can invest in both. It helps you balance safety and higher growth in your retirement portfolio.

What is the main difference between NPS and PPF?

The difference between NPS and PPF lies in returns and risk. NPS offers market-linked returns, while PPF gives fixed, government-backed returns.

Which gives better returns, PPF or NPS?

NPS generally offers higher returns over the long term, but PPF provides stable, risk-free returns.

Is NPS better for tax savings than PPF?

Both offer tax benefits. NPS allows up to ₹2 lakh deductions, while PPF offers up to ₹1.5 lakh under Section 80C.

What happens to my NPS or PPF after retirement?

In NPS, you can withdraw 60% and get a pension from 40%. In PPF, you can withdraw the full amount after maturity.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment