Is Gratuity Taxable In India?

You have been a loyal employee for years, and upon your resignation, you received a generous payout package from your employer. Well, think of gratuity as a financial 'thank you' for your years of service. However, according to a survey by Grant Thornton, 99% of respondents felt that their gratuity is insufficient. Nonetheless, receiving gratuity can feel rewarding, but for many people, a question often arises: 'Is gratuity taxable in India?'

Well, for some employees, gratuity can be completely tax-free, while others must pay taxes on it. The rules regarding taxation on gratuity depend on whether you are working in the private sector or are a government employee. If you are planning your retirement and wondering whether taxes will apply to your gratuity, it is essential to understand the details.

In this article, we will break down the different aspects of gratuity, shed light on the gratuity exemption limit, and answer whether gratuity is taxable or not.

What is Gratuity?

Gratuity is a statutory benefit. It is given by employers to the employees as a token of gratitude for their long-term association with the firm. Gratuity is paid and governed in accordance with the Payment of Gratuity Act, 1972. Here are the conditions when gratuity will be payable:

- When an employee resigns or retires after serving a minimum of 5 years of continuous service.

- When an employee leaves the firm as a result of superannuation.

- In case of death or permanent disability. (In this case, completing 5 years of service is not mandatory.)

Let us understand some other aspects of gratuity:

- Gratuity is applicable to organisations that have employed 10 or more people at any point in the last 12 months. Once applicable, it continues even if the employee count drops below 10.

- It is a lump sum amount paid in a single payment.

- Gratuity is calculated based on salary (basics + DA) and length of service.

- The employer bears the full cost of gratuity; the employee does not contribute to it.

In December 2021, the tax exemption limit on gratuity in India was increased to Rs 20 lakhs.

How to Calculate Gratuity?

Another question that arises when it comes to gratuity is, ‘How to calculate gratuity?’ Considering that gratuity and its calculation are still the most misunderstood concepts, let's understand how to calculate gratuity:

Formula to calculate gratuity:

- Gratuity = 15 x Last drawn salary x Number of years of service / 26

Here:

- The last drawn salary includes basic pay, along with a dearness allowance.

- The number of years of service will be rounded up if the period exceeds 6 months in the last year.

Let us understand this with an example:

If the last drawn salary is Rs 50,000 and the service is 10 years:

Then the gratuity calculation will be:

- Gratuity = (15 x 50,000 x 10) / 26

- Gratuity = Rs 2,88,462

Is Gratuity Taxable in India?

Understanding whether gratuity is taxable or not is necessary for effectively planning your finances. The short answer to this question is yes; gratuity is taxable under Indian law, but there are exemptions and limitations to this as well.

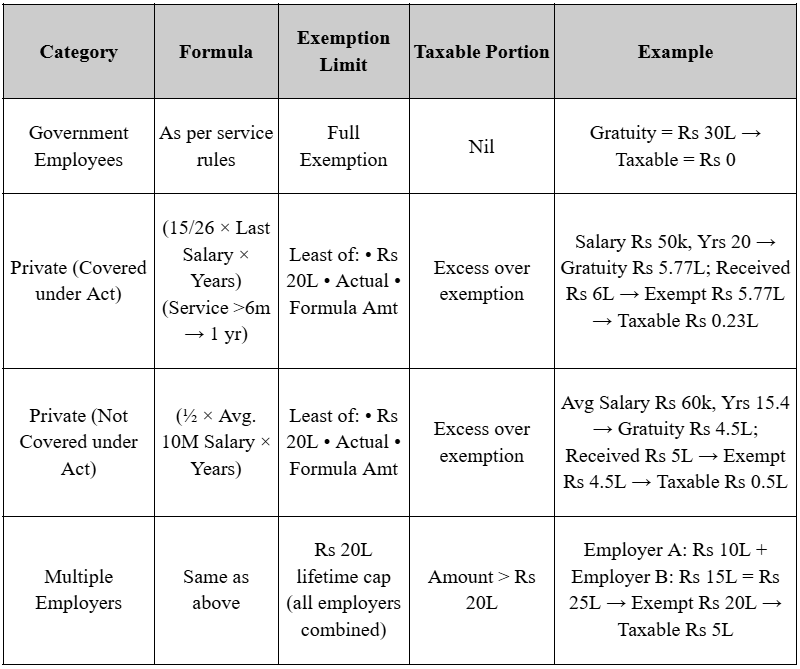

The applicable exemption is as per the Income Tax Act 1961. Gratuity is covered under Section 10(10) of the Income Tax Act. Here is the breakdown for better clarification:

1. Government Employees

Whether a government employee works for the central, local, or state government or even in the defence sector, the gratuity which is received is fully exempt from taxation. There is no cap on the amount. The entire gratuity amount is tax-free.

Example: If a government employee has received Rs 25 lakhs as gratuity, the entire 25 lakhs is tax-exempt.

2. Private Sector Employee (Covered Under the Payment of Gratuity Act, 1972)

Any private organisation that has 10 or more employees will come under the Payment of Gratuity Act. Then the exemption is the least of the following:

- Rs 20 Lakhs (this is the maximum gratuity exemption limit as per recent laws).

- Actual gratuity received.

Example: If the gratuity received is Rs 18 lakhs, the entire amount will be exempt from tax. If you have received Rs 25 lakhs, then Rs 20 lakhs is exempted, and the remaining Rs 5 lakh is taxable.

3. Private Sector Employee (Not Covered Under the Payment of Gratuity Act, 1972)

For organisations that are not covered under the Payment of Gratuity Act, the gratuity exemption limits will be the least of the following:

- Rs 20 Lakhs (this is the maximum gratuity exemption limit as per recent laws).

- Actual gratuity received.

- Half a month's average salary (based on the last 10 months' salary) × Completed years of service.

So, whether you are looking to change your current job or want to retire early, you can avail yourself of gratuity based on these rules.

Gratuity Calculation & Tax Implications

Here are the different scenarios and the subsequent gratuity calculations and tax implications:

Important Points to Remember

Here are some of the points about gratuity and taxation on gratuity:

- The current exemption limit is Rs 20 lakh for non-government employees (revised from Rs 10 lakh in 2018).

- For employees working across multiple employers, the exemption limit of Rs 20 lakh applies across their lifetime, not per employer.

- Even if gratuity is fully exempt from tax under Section 10(10) of the Income Tax Act, it must still be reported under "Exempt Income" in the ITR (Income Tax Return).

How to Check Gratuity Amount?

Knowing how much gratuity you will receive will help you plan your finances better. It becomes even more necessary when planning for retirement or considering a job change. There are several ways to check your gratuity amount, and they are explained as follows:

- Use the formula to calculate gratuity as per the Payment of Gratuity Act 1972.

- When you resign or retire, your HR department will automatically calculate the gratuity amount. You can also request that the HR department provide you with the details.

- You can also use online gratuity calculators on different platforms. These platforms will help you to know the gratuity amount as well as the tax-exempt portion.

- Some organisations may mention gratuity breakdown on salary statements.

Knowing if gratuity is taxable can help create a personalised financial plan.

Conclusion

Gratuity is a financial reward for your loyalty and long-term service. The answer to the question, 'Is gratuity taxable in India?' is not a straightforward yes or no; it involves several layers. For a government employee in any sector, the entire gratuity amount is tax-free; however, for private sector employees, the gratuity exemption limit is Rs 20 lakhs (revised). Knowing the gratuity exemption limits will help you plan your finances more effectively. Gratuity is a hard-earned benefit, and with proper knowledge, you can make the most of it without losing it to taxes.

FAQs

Is gratuity taxable in India?

Yes. However, for government employees, gratuity is fully tax-exempt. For private-sector employees, it is exempt up to Rs 20 lakh. Any amount above this is taxable.

Do I need to complete 5 years of service to receive gratuity?

Yes. A minimum of 5 years of continuous service is required. However, in the event of death or disability, gratuity is payable even if the 5 years are not completed.

Is there TDS on gratuity?

Yes. Employers deduct TDS on the portion of gratuity that is taxable (amount exceeding the exemption).

Do I have to declare gratuity in ITR if it is exempt?

Yes. Even if fully exempt, gratuity must be reported under "Exempt Income" in your income tax return.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment