FINANCIAL PLANNING FOR NEW PARENTS: FROM BABY STEPS TO BIG MILESTONES

Welcoming a baby is one of life’s most magical moments, filled with joy, love, and endless wonder. But alongside the cuddles and first smiles comes an undeniable truth every parent quickly realizes: your financial priorities have shifted, and planning for the future has never been more important.

The child comes with long-term financial responsibilities with significant costs in recent times, be it funding of daughter’s education or planning for son’s marriage... These commitments significantly reshape your budget, insurance needs, and investment priorities.

However, the real cornerstone of their future and the most important goal of all is their education.

- The Education Challenge: Costs Are Rising Faster Than Inflation

Education is more or less a long-term financial project for parents. Early planning for it is not only vital but also necessity because:

Escalating School Fees

- Private school tuition in India can start at ₹1–2 lakh per year in metro cities for primary classes and rise to ₹5–7 lakh per year by the time a child reaches higher secondary school.

- Annual fee hikes of 8–12% are common, meaning costs can double every 6–8 years.

University & Higher Education

- Higher education is a significant investment. Scholarships and aided seats are a bonus, but planning for the full cost ensures your child’s goals aren’t compromised.

- Private colleges across India charge 3-5x more than government quota fees. Ranging around ₹15–30 lakh a year for MBBS, and ₹8–15 lakh for an MBA at top private institutes. Engineering can cost ₹10-12 lakh or more for a four-year program.

- The cost of education abroad varies widely depending on the program, and scholarships are often limited, making careful planning essential.

- Traditional plans like SSY (for girl child) and PPF offer stable, tax-free returns, but alone they’re not enough to meet rising education costs.

Education inflation for higher studies is estimated at 10–12% annually—far higher than general consumer inflation hence starting sooner is better..

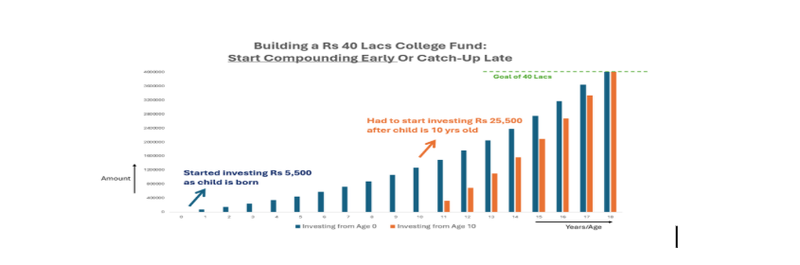

2. The Impact of Delay

Delaying investments for educational needs of your child by even five years can double the required monthly savings because compounding time is lost! For example:

Saving for a ₹40 lakh college fund in 18 years requires roughly ₹5,500/month at 12% annual return. Waiting until the child is 10 years old means you need nearly ₹25,500/month to reach the same goal.

Many young parents (can) start planning their child’s finances themselves - yes, SIPs might sound as simplistic as it looks from the chart above - but professional guidance is much more than that..!

3. Why DIY Planning Falls Short & How a Financial Planner Adds Value:

Parents often underestimate inflation, overlook smaller expenses, ignore currency risk, or compromise retirement savings for child goals. A financial planner bridges these gaps by setting realistic targets, creating goal-based portfolios, optimizing taxes, managing risk, and reviewing progress—turning aspirations into a solid practical roadmap.

4. Financial Roadmap for your child – How to get started?

For our dear parents-to-be and new parents, here’s what our financial planners say about how to structuring your finances works:

Before Birth & Early Years (Age 0-3)

Build an emergency fund covering 6–12 months of expenses, including maternity and childcare costs, and ensure health insurance covers both mother and newborn. Post-birth, enhance life and health insurance and start an education SIP early to benefit from long-term compounding.

Preschool to Primary (Ages 3–6)

Create a dedicated account or short-term debt fund to manage annual fee hikes. Budget for extracurricular activities as well - transportation, and uniforms can add 20–30% to base fees.

Middle & High School (Ages 7–16)

This phase brings growing educational and developmental needs—higher school fees, extracurriculars, coaching, technology, and health expenses. Parents can also start preparing for competitive exams while gradually rebalancing long-term education funds.

Higher education (UG and PG) and further

This phase is often the most critical in a child’s education and path to independence. Parents may face significant financial challenges, especially if private seats or overseas programs are involved. Careful planning and a flexible strategy are essential to support your child’s aspirations without disrupting other goals.

Education loans are surely a useful backup if your corpus falls short, with the added advantage of tax-deductible interest under Section 80E… but preplanning is necessary there too!

In addition, needless to say, weddings in India are also parental responsibility - as they are lavish and costly with rising gold and event-planning expenses. Starting a dedicated marriage fund early also ensures better financial readiness.

5. The Bottom Line

Raising a child brings joy—and funding their education or marriage is a major financial responsibility. Starting early, saving consistently, and working with a professional planner can help you. With the right plan and advisor, these long-term commitments can become a secure and rewarding future!

Plan today for your child’s tomorrow.

Speak with a FinAtoZ financial planner to create a roadmap tailored to your family’s financial goals.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment